Is Odoo's accounting suitable for the Netherlands? In this blog we would like to tell you about the applicability of the Accounting module of Odoo for the Dutch bookkeeper and accountant. No time or inclination to read the whole story? Click here for the short summary.

"Can Odoo also generate an audit file so that my accountant can easily work with my figures?" This question is often asked before a prospect chooses an Odoo implementation. "Does Odoo also have a year-end closing?" is another question that we cheerfully answer in the negative. Odoo has a nice flexible (read: stress-free) solution for closing the fiscal year.

Not only does the Odoo version have an audit file in the latest version, but the entire accounting module is also a serious competitor for the 'big boys', such as Exact Online and AFAS. This thanks to the clear dashboard, insightful reports, links with payment processors and the seamless integration with your other modules.

Odoo thinks along with you

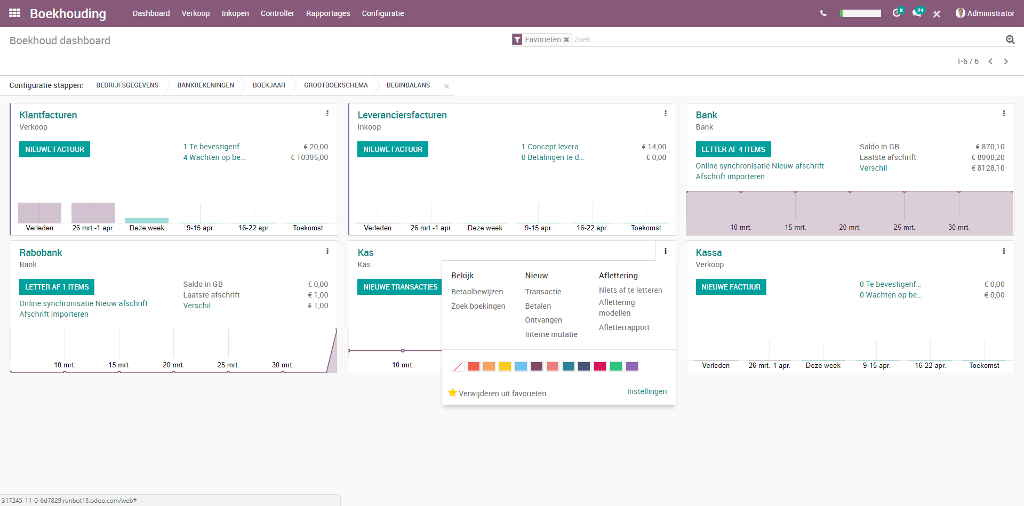

When you open the accounting module, you immediately end up on the dashboard.

An overview of your financial status is shown here: outstanding items, bank statements to be reconciled and bank balances. In addition, each diary contains a button to immediately start a new entry. This way you can get started quickly.

Odoo also thinks along with you when processing invoices. You record the specific payment conditions and the tax position for each supplier. As a result, invoices are automatically given the correct due date and entries are automatically routed to the revenue account for non-domestic cost price. Of course with the correct VAT coding and calculation.

Do you have an invoice within the EU? It will then appear on the invoice

state that the VAT percentage is 0%. Within Odoo, the

entries created for the VAT to be paid and input VAT.

Handy for the VAT return every month or every quarter.

VAT declaration and ICP report…

When that VAT return is imminent, with Odoo you are only two clicks away from your on-screen return. All turnover and VAT are clearly grouped and ready to be included in your online declaration. Thanks to the dynamic nature of these and other reports in Odoo, you can easily switch declaration periods, administration and basis of the declaration.

This base is of course nice, but is it not more than normal these days for a package to have this? So do all software packages have an ICP report at the touch of a button? In any case, it is!

Profit and Loss, Balance and much more!

Odoo has much more to offer. How about a real-time Profit & Loss report? At category level for the financial manager, but the controller can easily zoom in to the underlying general ledger accounts and entries. By default, the gross profit, the EBITDA and the net result are calculated.

Do you want to compare data with previous periods? No problem! Odoo also offers the necessary flexibility here. Compare with months, years or even quarters. Just a few clicks and the multi-year overview appears on your screen. Zoomed in on booking level or back via the crumb trail to the main overview? Thanks to the renewed interface, Odoo continues to provide quick overviews..

It is also possible to set up a trial balance with Odoo. Of course, with or without hierarchy, standard with opening balance, with the desired diaries: you choose.

Furthermore, Odoo is standard equipped with links to payment processors, such as Buckaroo, Paypal, Adyen and Ingenico (formerly Ogone). Setting up is simple and the choice of actions regarding payments is free. You decide which messages are sent to the customer, which payment methods are supported and how the bookings are processed. If you are not sure about the setup, you have the option to test each setting. You only pay for real transactions..

Odoo for the accountant: approaching the year-end with confidence

As an accountant, do you want a specification of the outstanding items at the end of the fiscal year? Then open the overview of 'Age Customer invoices'. Choose the standard filter 'end of the previous financial year'. Want to go back several years? Then simply enter the desired day and your overview will appear. No more hassle with switching to another administration. You simply select another company in your report and you're done. Naturally, this also applies to supplier invoices..

But what about the year-end closing? Because Odoo doesn't do that. And we are very happy with that!

Previous years remain available, but can no longer be changed. Setting a blocking date for the users and bookkeeper ensures that no changes can be made for that fiscal year after the annual figures are submitted. Only the accountant can change the data: the data cannot be changed by the employees. You can also set the date of the last day of the fiscal year yourself. This way you decide for yourself which period this concerns.

Full integration

Thanks to the integration with the other modules, printing out 'invoices yet to be received' is simple. With an automatic stock link, it is automatically entered in the accounting system. Or you run an overview of purchase orders with the status 'invoice not received'. So you no longer have to search for orders that have yet to be invoiced. With the sales overview 'orders to invoice' you can invoice every delivery paperless.

But repairs and written time can also be easily invoiced. For example, do you want a cost price calculation of make parts? No problem for Odoo. With a button next to the product, the cost price is determined based on the bill of materials. Also check the 'cost analysis' report immediately to check whether the cost price is still appropriate..

Custom reports

Odoo has an extensive range of standard reports. However, it may happen that they do not meet your specific wishes. Please rest assured, and contact us and ask us about the possibilities of a customized report. Then together we will see what is important to you and we can make various classifications using labels and groups.

The short summary:

AlleAlles op een rijtje.

Odoo is now a fully equipped system: also for accounting. The entry of new data is simple via a user-friendly interface. All necessary reports can also be requested. From a clear VAT return and ICP report to an audit file and a Profit & Loss report that allows you to compare with previous periods and multiple administrations: the options are very extensive. In addition, additional reports can always be created. Whether it is based on an existing report or whether it is built from scratch: you decide.

In addition to the audit file for the accountant, Odoo also generates an overview of outstanding debtors or creditors at year-end. Once the figures have been provided to the accountant, Odoo can be blocked for that financial year, while the accountant retains access to make corrections. This ensures that no further changes are made for that fiscal year.

The webshops are also being considered. There is a wide choice of payment processors such as Buckaroo, Paypal, Adyen and Ingenico. Moreover, you have a lot of freedom to set up and test the payment options yourself.

Thanks to the full integration with the other modules in Odoo, your stock and 'invoices to be received' are easily requested or automatically included in the accounting. It is also possible to invoice from repairs or timesheets. Cost prices of parts and make parts are calculated on the basis of purchasing, stock and bills of materials.

In short: a complete module for bookkeepers and accountants!